STRATEGIES FOR

THINKING CREATIVELY

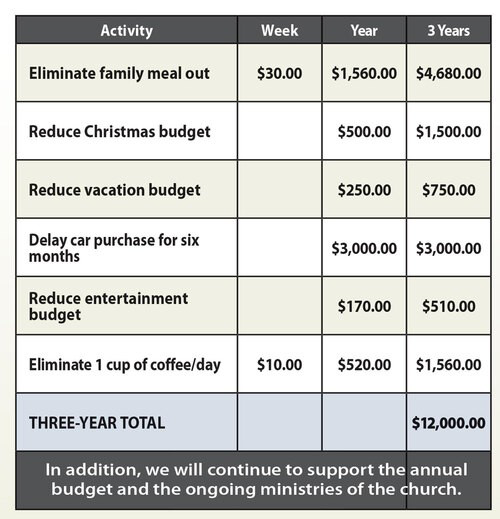

For many of us, it will take some shifting of priorities and reallocation of resources to participate in IMAGINE MORE TOGETHER. Here are some ideas on how to do that creatively:

DECREASE SPENDING

What are some of the weekly splurges in your life that you could probably do less often? Fancy coffee or smoothies? Eating meals out? “Target Runs” for milk that turn into full shopping carts? Amazon boxes showing up on your porch daily? By simply being mindful of your weekly expenses and finding ways to decrease your spending (sticking to your list), your savings can add up.

DELAYED EXPENDITURES

Postponing major expenditures such as automobiles, home projects, or trips provides substantial giving opportunities. Would you pray about delaying those plans and instead allocating the funds toward this vision?

DO-IT-YOURSELF PROJECTS

What are some things in your life that you typically “hire out” instead of doing yourself? Maybe it’s the lawn or painting. Maybe it’s making your lunch a few days a week instead of eating out. Perhaps it’s basic plumbing or carpentry. Not only could you save money by hiring yourself for the job, but you could also gain the satisfaction that comes from accomplishing a new skill.

DONATE ASSETS

A great way to contribute is to give existing assets. Giving the asset (e.g., Real estate, stock, gold) to Stafford Crossing and then allowing the church to sell it eliminates potential capital gains taxes and may increase after-tax proceeds. Please contact Kathy Cosner at kathy@staffordcrossing.org to discuss the viability of the asset.

DIVERTED-FUNDS GIFTS

Freeing up funds currently allocated to other areas of spending enables a person to increase their giving to God’s work. Diverting funds from entertainment, dining out, dues, subscriptions, gifts, allowances, or transportation can lead to lifestyle adjustments that impact one’s giving.

CASH FLOW GIFTS

Smaller gifts add up! By giving smaller amounts at higher frequencies–such as weekly, semi-monthly, or monthly–large gifts can be achieved in smaller steps. Using electronic funds transfers can be beneficial when making these gifts.

INCOME-PRODUCING ASSETS

Interest income, payments from rental properties, or monies from other income-producing assets provide a source for increased giving.

SALE OF ASSETS

The sale of major assets, such as a house, car, land, or business, provides a source of available income for giving.

RAISES/BONUSES/TAX REFUNDS

Contributing raises, bonuses, and tax refunds are also creative methods that can be used to increase giving.

FREEDOM FROM DEBT

Looking ahead to the next three years, you may discover that debt obligations will be fulfilled. This frees up revenue for additional giving.

UNIQUE-SKILLS INCOME

Some people have marketable hobbies or skills that enable them to give from those new profits.

SAVINGS AND ANNUITIES

Savings for special projects, retirement, or a “rainy day” may offer a resource for increased giving. We often realize that a portion of our savings may safely be given to the work of

God’s Kingdom through our church.

God’s Kingdom through our church.

SPECIAL TAX-FREE IRA GIFTS

Using a Traditional IRA

If you are 70 1/2 years old or older, you can donate up to $108,000 per year to Stafford Crossing without incurring a penalty or tax liability. A gift from a traditional IRA can assist in satisfying a minimum distribution requirement (RMD) and may lower your overall tax liability. Remember that for preferable tax treatment, a gift from a traditional IRA should

pass directly to a beneficiary and should not pass through an intermediate account. is where the description goes.

Using a Roth IRA

If you are 59.5 years old or older, you can make a tax-free withdrawal in any amount from your Roth IRA and donate to Stafford Crossing. Regardless of your age, you can withdraw your annual IRA contribution amount and donate to Stafford Crossing without incurring a penalty or tax liability.

If you are 70 1/2 years old or older, you can donate up to $108,000 per year to Stafford Crossing without incurring a penalty or tax liability. A gift from a traditional IRA can assist in satisfying a minimum distribution requirement (RMD) and may lower your overall tax liability. Remember that for preferable tax treatment, a gift from a traditional IRA should

pass directly to a beneficiary and should not pass through an intermediate account. is where the description goes.

Using a Roth IRA

If you are 59.5 years old or older, you can make a tax-free withdrawal in any amount from your Roth IRA and donate to Stafford Crossing. Regardless of your age, you can withdraw your annual IRA contribution amount and donate to Stafford Crossing without incurring a penalty or tax liability.

NOTE: Any discussion of tax treatment is not intended as and should not be considered tax advice. For personal tax advice, consider consulting with a professional tax advisor. Donors may include 100% of the market value of many non-cash assets as a charitable contribution if the asset is held for more than one year.

A look at one family's commitment to increased giving